“`html

Effective Ways to Calculate Revenue in 2025: Understand Your Greater Earnings

Understanding Revenue Metrics

To start navigating the world of financial performance, it’s crucial to grasp the concept of **revenue** metrics. Revenue metrics reflect the overall financial health of a business, providing insights into its operational efficiency and growth potential. Key metrics include **revenue growth**, which indicates how well a company is expanding its income streams, and **revenue trends**, which identify fluctuations and patterns over time. This understanding aids in developing a robust **revenue strategy**.

Interpreting Revenue Streams

Every business has distinct **revenue streams**, categorized into various types such as **subscription models**, **product sales**, and **service fees**. Understanding these different streams is essential for accurate **revenue calculation**. Identifying which streams are performing well can facilitate the optimization of resources and marketing strategies. For example, a software company may have recurring monthly subscriptions constituting a majority of its **business revenue**. By analyzing these, the company can forecast future earnings with greater accuracy.

Key Revenue Formulas

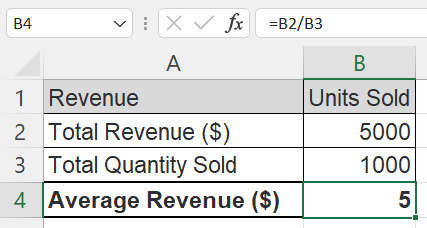

Utilizing **revenue formulas** aids in quantifying income effectively. The common formula used is:

- Revenue = Price x Quantity Sold

This straightforward equation can be modified to account for discounts, returns, and other variances for more precise **revenue estimation**. Furthermore, understanding more complex formulas like weighted averages or using predictive models can enhance **revenue projections**, making them a vital aspect of financial planning.

Revenue vs. Profit: A Clarification

When discussing financials, it’s important to differentiate **revenue vs. profit**. While revenue refers to the total money generated before deducting expenses, profit accounts for those costs. Effective **revenue analysis** is critical to identify how successfully a company converts its revenue into actual profit, thus driving informed decisions regarding cost minimization and operational efficiency.

Revenue Forecasting Techniques

Predicting future performance through **revenue forecasting techniques** is indispensable for any business aiming for sustainability and growth. Harmonizing accurate forecasts can help in better resource allocation and strategic investments. Businesses commonly employ methods like time-series analysis and regression models to project future **revenue trends** based on historical data.

Utilizing Historical Data for Revenue Insights

Analyzing historical data offers a foundation for understanding how revenue behaves over time. For instance, examining quarterly earnings can help identify patterns and seasonal effects that significantly impact **revenue generation**. Companies can adjust their strategies based on this data, leading to enhanced **revenue optimization** efforts.

Revenue Growth Strategies

Implementing effective **revenue growth strategies** comprises various activities directed towards increasing sales or expanding market reach. Strategies may include diversifying product lines, exploring new geographical markets, or even investing in technology to enhance operational efficiencies. By actively seeking opportunities for growth, businesses can significantly improve their respective **revenue objectives**.

Understanding Revenue Variances

Regularly assessing **revenue variances**—the differences between projected and actual performance—allows for timely adjustments to business strategies. Variance analysis provides insights into unexpected changes in revenues, enabling businesses to identify drivers behind such shifts, such as economic conditions or changing customer preferences.

Revenue Management Strategies

**Revenue management** encompasses a set of techniques aimed at maximizing income through demand-based pricing strategies, inventory control, and market analysis. Leveraging these strategies allows businesses to adapt quickly and effectively to changes in market demands, enhancing overall profitability.

Effective Methods of Calculating Revenue

Employing various **methods of calculating revenue** ensures businesses don’t overlook potential income generators. Techniques like **customer segmentation** allow firms to tailor offerings based on customer groups, unlocking additional revenue streams potentially. It’s crucial to monitor these methods closely for effectiveness, adjusting strategies as necessary.

Incorporating Financial Technology in Revenue Tracking

Utilizing **financial technology** tools for **revenue tracking** can streamline revenue reporting processes. These tools often offer analytics capabilities, automating the tracking of revenue streams and providing real-time insights into performance indicators. Businesses that leverage technology are better positioned to respond promptly to market changes and optimize their revenue generation efforts.

Revenue Implications on Decision Making

The insights derived from analyzing revenue data can significantly influence key business decisions. Understanding underlying **revenue implications** empowers management to make informed choices regarding investment opportunities, cost controls, and strategies for business expansions, ultimately impacting long-term success.

Key Takeaways

- Understanding and analyzing different revenue streams is crucial for accurate revenue calculation and growth.

- Differentiating between revenue and profit helps businesses optimize their financial performance.

- Implementing strategic revenue forecasting can significantly enhance decision-making processes.

- Employing effective revenue management strategies can maximize overall income and business sustainability.

FAQ

1. What are the main revenue sources in a business?

Main sources of **revenue** include sales of goods and services, subscription fees, licensing royalties, and advertisement income. Each source may require different **revenue recognition** methods, which are crucial for accurate financial reporting.

2. How do you calculate revenue growth?

To calculate **revenue growth**, use the formula: [(Current Revenue – Previous Revenue) / Previous Revenue] x 100. This metric shows the percentage increase in revenue over a specific period, indicating the company’s performance.

3. What is revenue optimization?

**Revenue optimization** refers to the strategies used to maximize income through better pricing models, reducing costs, and improving sales techniques. It involves a meticulous examination of different **revenue models** to see which generates the most income based on existing market conditions.

4. Why is revenue forecasting important?

**Revenue forecasting** is vital because it helps businesses plan for the future by predicting income and aligning budgets accordingly. Accurate forecasts guide strategic decisions, investment priorities, and resource allocation, fostering steady business growth.

5. How can revenue metrics influence business strategies?

By analyzing **revenue metrics**, businesses gain insights into profitable areas and identify underperforming segments. These insights equip management to make targeted adjustments to strengthen sales strategies, promotional efforts, and overall operational efficiencies, thereby enhancing corporate profitability.

“`