How to Properly Fill a Check in 2025: Essential Tips to Avoid Mistakes

Filling out a check might seem like a simple task, but doing it correctly is crucial for ensuring accurate financial transactions. Whether you’re new to finance or just need a refresher, this guide will walk you through how to fill a check properly in 2025. Let’s delve into effective techniques that can help you avoid common check writing errors and keep your payments secure.

Understanding Check Information

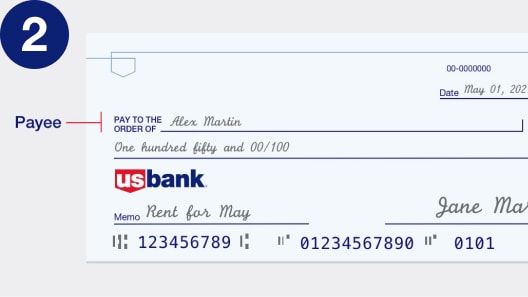

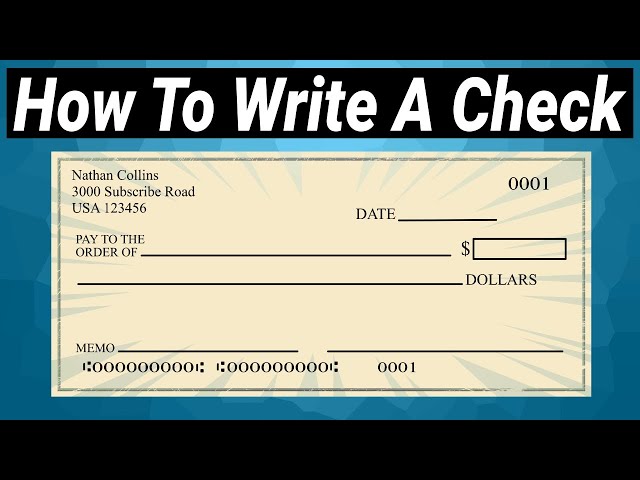

Before diving into the actual writing, it’s essential to familiarize yourself with the different parts of a check, often referred to as the check format explained. A typical check contains the date, payee name, amount in words and numbers, signature, and memo line. Understanding these components will ensure that when filling out a check, you provide all necessary details that validate the transaction.

Key Components of a Check

The layout of a check is structured for clarity. Starting from the top left, you’ll find the date line; this is typically where you indicate when the check is issued. The next section is where you’ll input the payee’s name, which is someone or a business to whom you are writing the check. This is followed by the numeric and written amount which represents how much you are paying. Lastly, your signature validates the check. Always use your usual signature to avoid issues with check security tips during processing.

Common Check Errors to Avoid

Filling a check correctly requires attention to detail. One of the most frequent mistakes includes writing the date incorrectly, which can cause confusion regarding the validity of the check. Another common error is mismatching the written amount with the numeric amount; always double-check that both match, as discrepancies could lead to **check writing mistakes to avoid**. A practical tip is to perform a final review before submitting to ensure that all information is accurate and clear.

Writing Accurate Checks

When writing checks, clarity is paramount. Using black or blue ink allows better readability and prevents alterations. Write legibly, ensuring that all characters are distinct to prevent any misinterpretation during check verification processes. Additionally, when filling out your check, be precise in the amounts to prevent fraudulent activities. If you make an error, it’s best to use a new check rather than trying to correct on the same one.

Check Writing Best Practices

Ensuring your checks are written professionally can prevent many issues. Follow these written checks tips to optimize your check payment method. Leave adequate space to avoid the use of unnecessary corrections which can cause delays in processing. Furthermore, if you’re unsure about the payee or the amount, it’s advisable to consult before writing the check to reduce errors.

Cross-Checking Information

Before sealing your envelope or handing your check over, it’s beneficial to cross-check all information. This check writing checklist includes verifying your account number, ensuring that it’s not being double-used (unless allowed), and confirming with bank account management guidelines before submission. Awareness of frequent mistakes can immensely streamline your payment process.

Understanding Check Payment Options

In 2025, applying a modern understanding of check payment options enhances how we transact. While checks are traditional, understanding other payment methods can provide alternatives if needed. Electronic checks, mobile check deposits, and app-based transfers are on the rise but knowing the traditional method still helps in financial literacy, especially for situations requiring paper checks.

Case Study: Filling a Check Quickly

Imagine you need to send a birthday gift to a friend via check. First, take out your personal checkbook and note the date effectively. Next, ensure you write your friend’s name clearly on the payee line. Decide on the gift amount and write it in both numerical and written forms on the relevant lines. Finally, sign the check using your usual signature. This is a straightforward example of filling a check correctly, demonstrating the simple step-by-step process of issue with ease.

Check Endorsement Instructions

Once you’ve filled out your check correctly, you need to understand the importance of endorsement. An endorsement is essentially a signature authorizing the cashing or depositing of your check. It serves as a final confirmation for both the sender and recipient regarding the form of exchange.

The Proper Way to Endorse a Check

To endorse a check, flip it over to the backside. Here, you’ll see a designated area where you should sign. Your signature should match the name on the front of the check. Neglecting to do this correctly can cause delays or failures in cashing or depositing the check. Always use a pen for a secure signature and—if possible—address your endorsement space so it’s professional and clear.

When to Use a Restrictive Endorsement

A restrictive endorsement adds an additional layer of security. Instead of simply signing, you might include “For Deposit Only” followed by your signature, which means that the check may only be deposited into an account—this is especially useful if you’re worried about check conflicts or loss.

Understanding the Endorsement Process

The endorsement process can also affect your clarity. If you’re passing your check on to someone for payment, they should understand how to handle the endorsement. This will ensure they also follow the proper check endorsement instructions, preventing any potential miscommunication or mishandling.

Key Takeaways

- Understand the components of a check to ensure proper formatting.

- Check for common errors to validate your checks and enhance security.

- Follow best practices for writing checks for accuracy and efficiency.

- Ensure proper endorsement to safeguard transactions against fraud.

FAQ

1. What is the best way to write a check to ensure clarity?

The clearest way to write a check is by using blue or black ink, writing legibly, and ensuring that both the numeric and written amounts match. Always double-check your information before signing to enhance validity.

2. Can I use any pen to fill out a check?

Using a pen, ideally from blue or black ink that resists fading makes checks harder to alter. Avoid using a pencil as it can be easily erased and changed, leading to potential check fraud.

3. What should I do if I make a mistake on a check?

If an error occurs while writing a check, do not attempt to cross it out or change it; it’s best to discard the check and write a new one. This prevents confusion and safeguards against possible dishonor.

4. Is it safe to send checks via mail?

Depending on the situation, sending checks through mail can be risky due to theft. Consider using a secure mailing method, or opt for electronic payments when appropriate to minimize risk.

5. What does it mean to endorse a check?

To endorse a check means to sign the back of it, allowing the transaction to proceed either for cashing or depositing. It verifies that you approve the transaction.

By following these guidelines, you can confidently write and manage checks securely and effectively.